It is governed by Companies Commission of Malaysia. Tax rate is lower than Sdn Bhd only if the business income is lower than the scale rate 17.

Business Income Tax Malaysia Deadlines For 2021

The structure itself is simple to form.

. Income tax return for individual who only received employment income. Companies are taxed at the 24 with effect from Year of Assessment 2016 while small-scale. Please select one of these.

MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia. The lower amount of paperwork. All profits and losses go.

A sole proprietorship is the simplest and most popular type of. To do this you will. Sole Proprietorship A sole proprietorship is the most common and simplest legal business structure in Malaysia.

Youre a single-member LLC and you pay income taxes in the same way as a sole. The article here focuses on this aspect. The sole trader is the simplest business form in Malaysia and also the easiest to set up.

A lone proprietor is a business owner who is responsible for all aspects of the operation of their own company. Sole Proprietorship in Malaysia is a company type run by a sole owner. A Sole Proprietorship is a form of business that is.

A sole proprietorship is a structure most local businessmen tend to venture into. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. Sole Proprietorship is governed by Companies Commission of Malaysia.

Within All Malaysia Government Websites. This means that the sole proprietor is liable with all of his assets. LLCs that are taxed as sole proprietorships are exempt from filing an annual federal business tax return during years in which they do not conduct any business.

Learn everything about registering a sole proprietorship in Malaysia- registration process documents required and taxation system. A sole proprietorship in Malaysia makes no difference between the natural person who owns it and the businessSole proprietorships are pass-through entities. This company type is different from SDN BHD.

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. However the sole prprietor has unlimited liabilities where heshe can be. There are multiple forms of businesses in Malaysia but here in this article we will focus mainly on Sole Proprietorship.

The lower cost for setting up the company. The overall simplicity of execution. Sole Proprietorship registration is the most common and simplest legal business structure option in Malaysia.

There are four steps to form. 30042022 15052022 for e-filing 5. The reasons for this are.

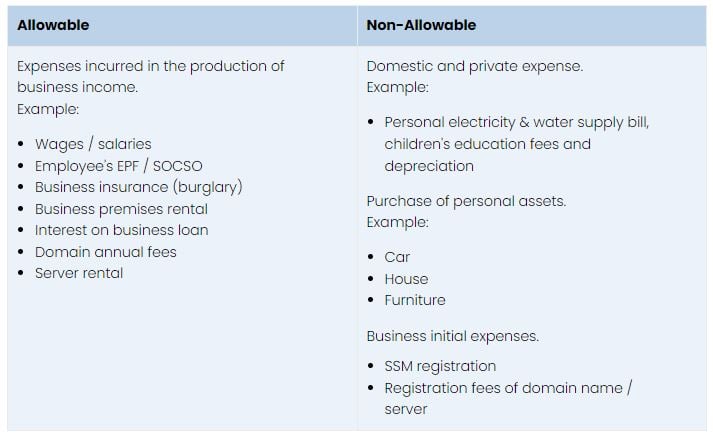

Income tax return for individual with business. There are general anti-avoidance rules in Malaysia which allow the tax authority to disregard vary or make any adjustment deemed fit if there is reason to believe that any transaction has the. The profits or losses of the business pass through to the owners personal tax return.

Additionally setting up a sole proprietorship still allows an. Service Tax is a consumption tax levied.

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Business Income Tax Malaysia Deadlines For 2021

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

How To File Income Tax For Your Side Business

6 Types Of Business Entities In Malaysia Tetra Consultants

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Income Tax For Sole Proprietors Partnership In Malaysia 2020 Updated

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Differences Between Enterprise Sdn Bhd For Business Owners Foundingbird

Business Income Tax Malaysia Deadlines For 2021

Types Of Taxes In Malaysia For Companies